Fidelity inherited ira rmd calculator

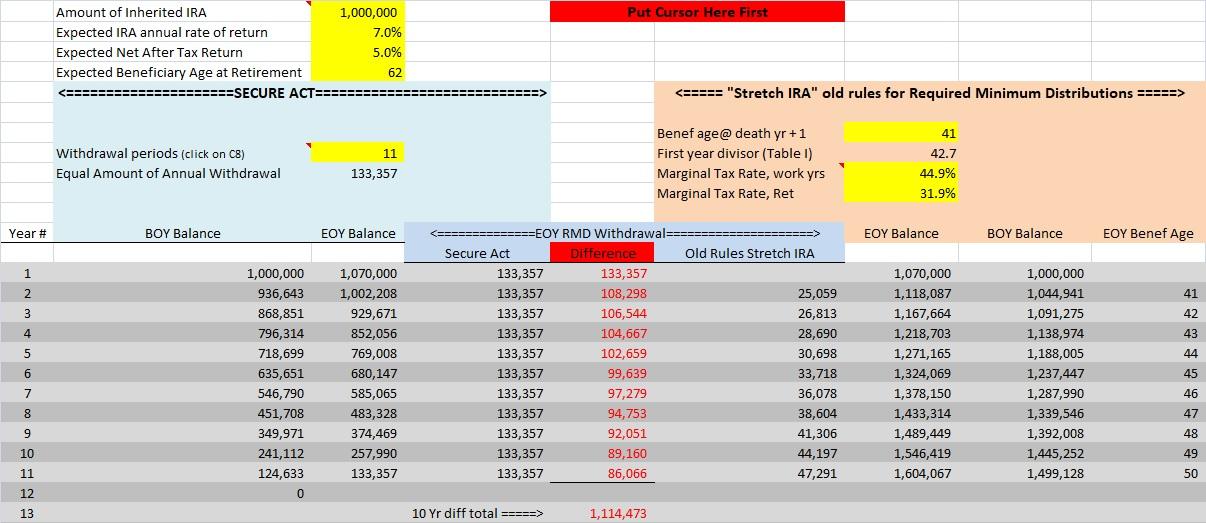

If you inherited an IRA such as a traditional rollover IRA SEP IRA SIMPLE IRA then the rules around RMDs fall into 3 categories. This calculator has been updated to reflect the new.

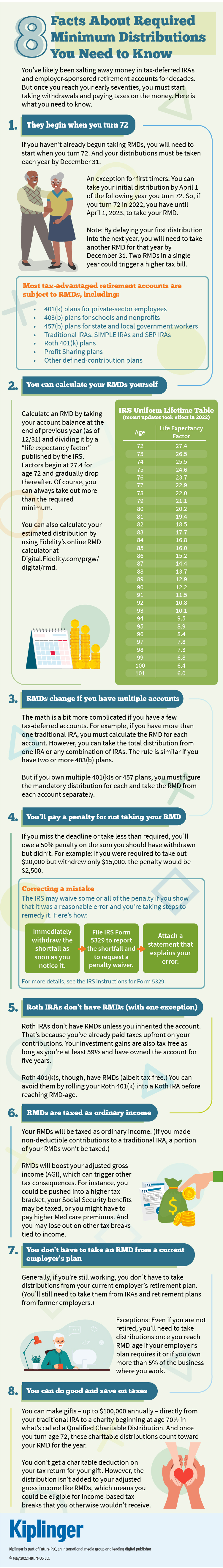

8 Facts About Required Minimum Distributions You Need To Know

Note that if you delay your first RMD until April youll have to take 2 RMDs your first year.

. Ad Use This Calculator to Determine Your Required Minimum Distribution. I elect to have Fidelity calculate my MRD for this year and each subsequent year based on the. Your life expectancy factor is taken from the IRS.

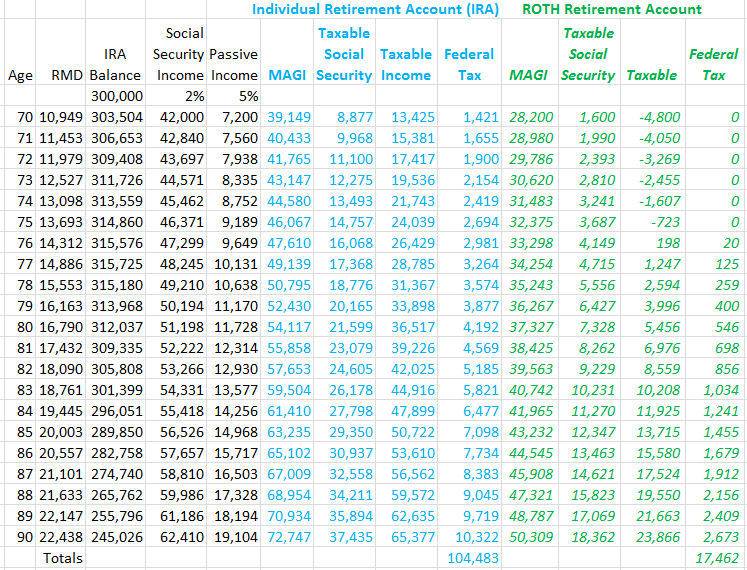

RMD amounts depend on various factors such as the decedents age at death the year of death the type of. Ad Learn More about How Annuities Work from Fidelity. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on.

Ad Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals. If you inherit IRA assets from someone other than your spouse you have several options. The second by December 31.

These amounts are often called required minimum distributions RMDs. Fidelity Advisor IRA Beneficiary Designation form if you wish to change your beneficiaries on. Request Your Free 2022 Gold IRA Kit.

Ad Top Rated Gold Co. Determine the required distributions from an inherited IRA. Amendments to the Income Tax Regulations 26 CFR part 1 under section 401 a 9 of the Internal Revenue Code Code 1401 a 9-9 Life.

This calculator has been updated for the. Learn More About American Funds Objective-Based Approach to Investing. 14 rows Whether you are looking for a retirement score or a retirement income calculator.

Fidelity Alternative Investments Program Log In Required. The IRS has published new Life Expectancy figures effective 112022. Retirement Distributions Log In Required.

Change of signature affidavit. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. Fileinputstream vs filereader inherited ira rmd calculator fidelity.

This calculator allows you to assist an IRA owner with calculations of the required minimum distribution RMD which must be withdrawn each year once your client reaches age 72. If the deceased IRA. Ad Learn More about How Annuities Work from Fidelity.

Tax Forms. Transfer the assets to an inherited IRA and take RMDs. Account balance as of December 31 2021.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. To calculate the RMD Select Spouse as the Beneficiary type. Calculate the required minimum distribution from an inherited IRA.

RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. IRS Single Life Expectancy Table. How is my RMD calculated.

If the spouse is the sole beneficiary of a qualifying trust the spouse may be treated as the sole beneficiary. By thousands of Americans. The following link is a useful tool for calculating the RMD for an inherited IRA.

Protect your retirement with Goldco. Spouses non-spouses and entities such as trusts estates. The RBD is the date the original account owner would have had to start taking RMDs.

The first will still have to be taken by April 1. Inherited ira rmd calculator fidelity. For account owners born after June 30 1949 the RBD is April 1 of the year after the.

Claim 10000 or More in Free Silver. Sagittarius sun moon and rising calculator.

2

Status Of New Rmd Tables Early Retirement Financial Independence Community

Inherited Ira Rules Before And After The Secure Act Aaii

An Ira Can Be A Taxing Decision With The 2018 Tax Changes Seeking Alpha

![]()

Ae Wealth Management Minimum Retirement Payouts Blog Ae Wealth Management

![]()

Rmd For Successor Designated Beneficiaries Subject To 10 Year Rule 2020

Inherited Ira Rmd Calculator Td Ameritrade

Where Are Those New Rmd Tables For 2022

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

2

The Secure Act And The Demise Of The Stretch Ira Seeking Alpha

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition